where's my unemployment tax refund irs

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit.

Unemployment Tax Refund Irs Zrivo

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

. If you filed on paper check Wheres my refund. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in March. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt.

Your tax on Form 1040 line 16 is not zero. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000. How will I know if IRS received my tax return and if my refund is being processed.

Return Received Refund Approved and Refund Sent. Updated 3 minutes ago. If youre due a refund from your tax year 2020 return you should wait to get it before filing Form 1040X to amend your original tax return.

September 13 2021. Check For the Latest Updates and Resources Throughout The Tax Season. Check your unemployment refund status by entering the following information to verify your identity.

For eligible taxpayers this could result in a refund a reduced balance due or no change to tax. Ad See How Long It Could Take Your 2021 Tax Refund. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

Do not file a second tax return. Another way is to check your tax transcript if you have an online account with the IRS. Viewing your tax records online is a quick way to determine if the IRS processed your refund.

You can use the IRS online tracker applications the Wheres My Refund and Amended Return Status tools. You did not get the unemployment exclusion on the 2020 tax return that you filed. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online.

See How to File for options including IRS Free. IRS problems in the last 24 hours in Brooklyn New York The following chart shows the number of reports that we have received about IRS over the past 24 hours from users in Brooklyn and near by areas. The Internal Revenue Service doesnt have a separate portal for checking the unemployment compensation tax refunds.

This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. Unemployment benefits are generally treated as taxable income according to the IRS. Your Adjusted Gross Income AGI not including unemployment is less than 150000.

While your tax return is being processed you can follow it through three stages. The unemployment exclusion would appear as a negative amount on Schedule 1 line 8 with the abbreviation UCE on the dotted line to the left of the amount. By Anuradha Garg.

Updated March 23 2022 A1. 22 2022 Published 742 am. One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

Tool provided by the IRS to follow your tax return from receipt to issuance of your refund. Heres how to check your tax transcript online. Will I receive a 10200 refund.

The agency had sent more than 117 million refunds worth 144 billion as of Nov. Current refund estimates are indicating that for single taxpayers who qualify for the 10200 tax break and are. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns.

Still they may not provide information on the status of your unemployment tax refund. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. Ad Learn About the Common Reasons for a Tax Refund Delay and What To Do Next.

You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. The refund average is 1686. This is because there is nowhere for your return to specifically go until the IRS begins accepting and processing returns for the tax season.

IRS collects taxes for the United States Government and offers the IRS e-File electronic filing service for individuals. If you filed electronically and received an acknowledgement you do not need to take any further action other than promptly responding to any requests for information. Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. The IRS suggests to check Wheres My Refund or you can view your account. The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state unemployment.

An outage is determined when the number of reports are higher than the baseline represented by the red line. Wheres My Refund tells you to contact the IRS. We will contact you by mail when we need more information to process your return.

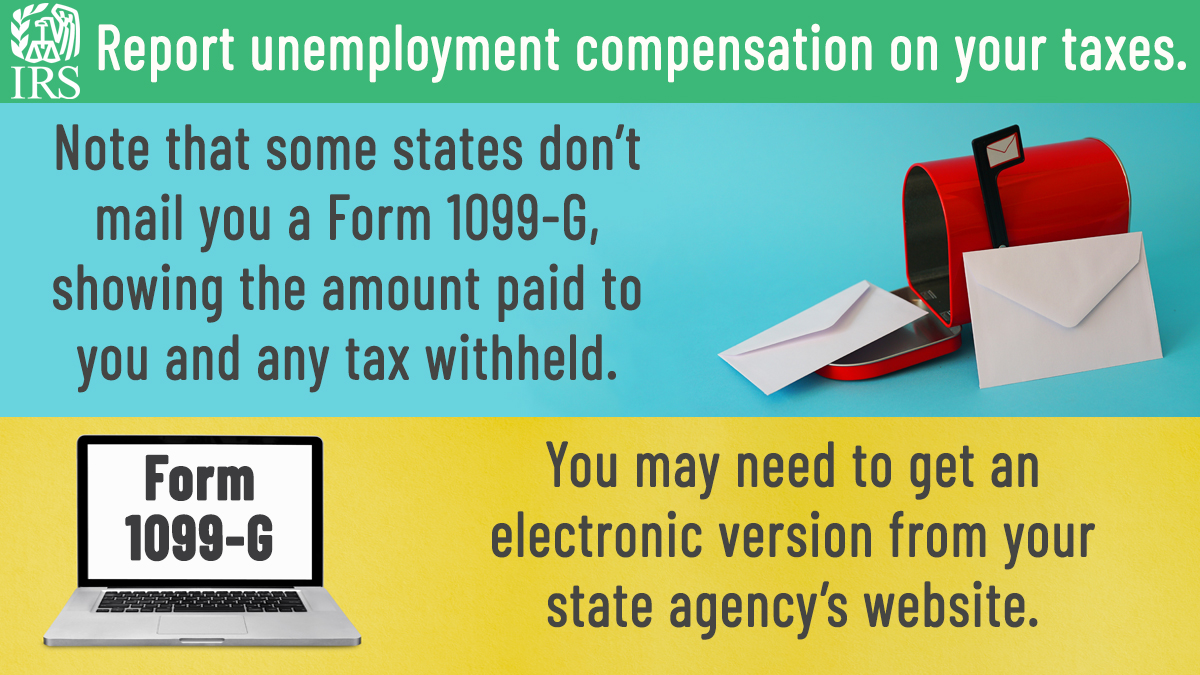

Until then any and all submitted tax returns for the current season are blocked from being put into the system so the IRS can finish any maintenance repairs updates and testing. Use the Wheres My Refund. You should receive a Form 1099-G showing in box 1 the total unemployment compensation paid to you.

IRS problems in the last 24 hours in Manhattan New York. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability.

IR-2021-159 July 28 2021. The following chart shows the number of reports that we have received about IRS over the past 24 hours from users in Manhattan and near by areas. 21 days or more since you e-filed.

For the latest information on IRS refund processing during the COVID-19 pandemic see the IRS Operations Status page. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued.

In general all unemployment compensation is taxable in the tax year it is received. Who Is Eligible For An Unemployment Tax Return. The IRS has sent 87 million unemployment compensation refunds so far.

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

Irs Unemployment Tax Refund Timeline For September Checks

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

1099 G Unemployment Compensation 1099g

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

Where Is My 2 200 Irs Slow To Rollout Unemployment Tax Refund The National Interest

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Irsnews On Twitter If You Received Unemployment Compensation During The Year You Must Include It In Gross Income On Your Irs Tax Return See Details At Https T Co Lhsbya2bvu Https T Co Vfio1irxik Twitter

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

The Ui Tax Refund On My Transcript 1 229 23 Is Less Then The Unemployment Taxes Paid 2 606 Shown On My 1099g Is There Any Reason For This R Irs

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Where S My Tax Refund Why Irs Checks Are Still Delayed

![]()

What To Know About Unemployment Refund Irs Payment Schedule More