utah state tax commission tap

The letter will direct you to take the quiz on our secure website at taputahgov. Office supplies office or shop equipment or computer hardware and software.

Utah State Tax Commission SFG PO Box.

. Taxpayer Access Point TAP. Your online session will timeout after 60 minutes of inactivity. Choose any of these for more information.

Still shows Pending in TAP click your payment link and Withdraw. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. Your session has expired.

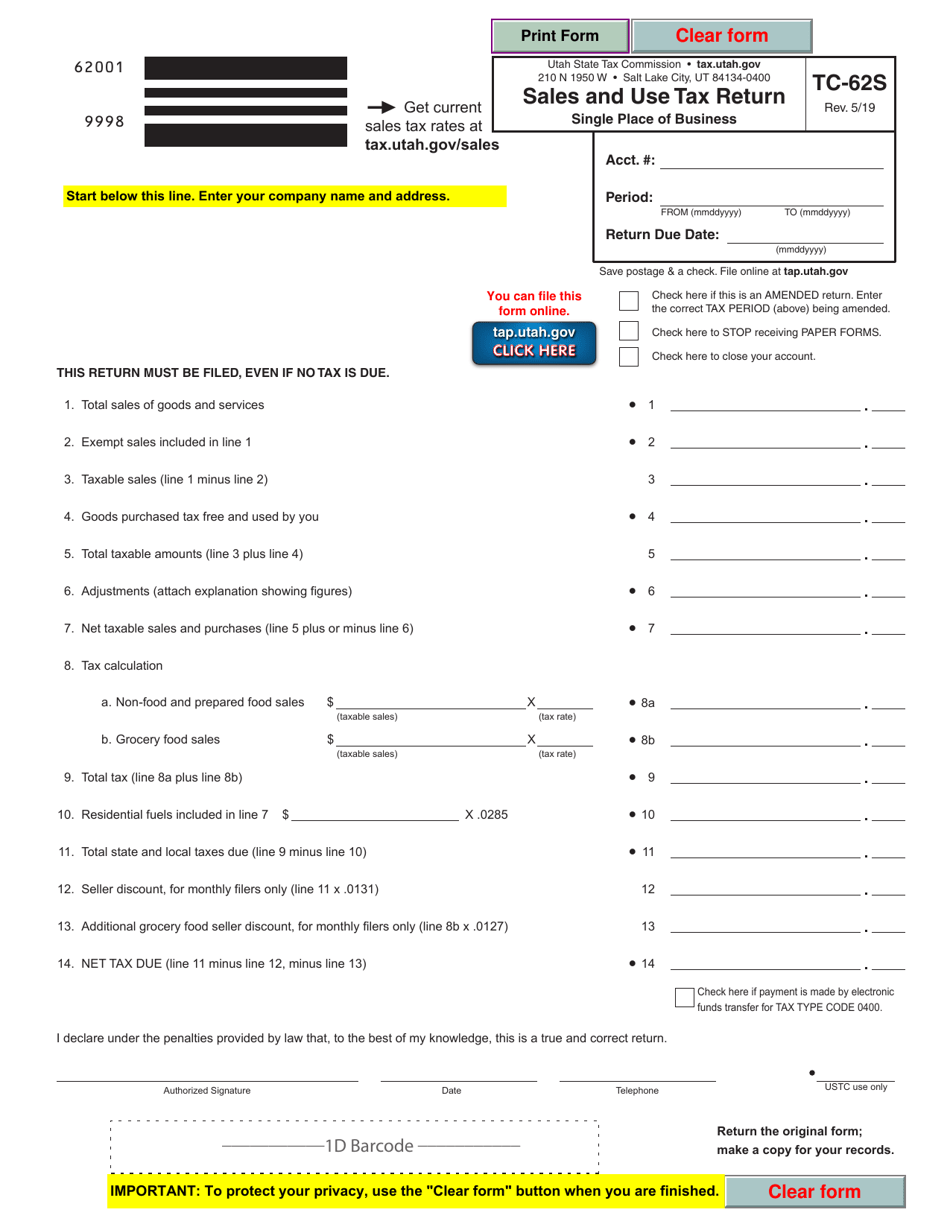

The Tax Commission is not liable for cash lost in the mail. What should I do. Enter the amount paid for items purchased tax-free that you did not resell but you used eg.

If you cant access your TAP account with the Forgot Username. The penalty for underpaying an extension prepayment is 2 percent of the unpaid tax per month of the extension period. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Pay the IRS Less Without Going to. Payment coupons are available for most tax types on the forms page. TAP will total this line for you.

The penalties are a percentage of the unpaid tax based on the number of days late. Mail your payment coupon and Utah return to. Official tax information for the State of Utah.

Goods purchased tax free and used by you. Motor Vehicle Enforcement MVED. On TAP Presented by Utah State Tax Commission.

If the return is not filed by the extension due date failure to file and pay penalties will apply as if the extension had not been granted. Official tax information for the State of Utah. Has already cleared your bank account contact Taxpayer Services at 801-297-7705.

Sales. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Click Here to Start Over.

You are being redirected to the TAP home page. Tax Instruction. Identity verification questions are based on information from your drivers license or state ID card and your Utah income tax returns for the previous one or two years if you had Utah tax returns for those years.

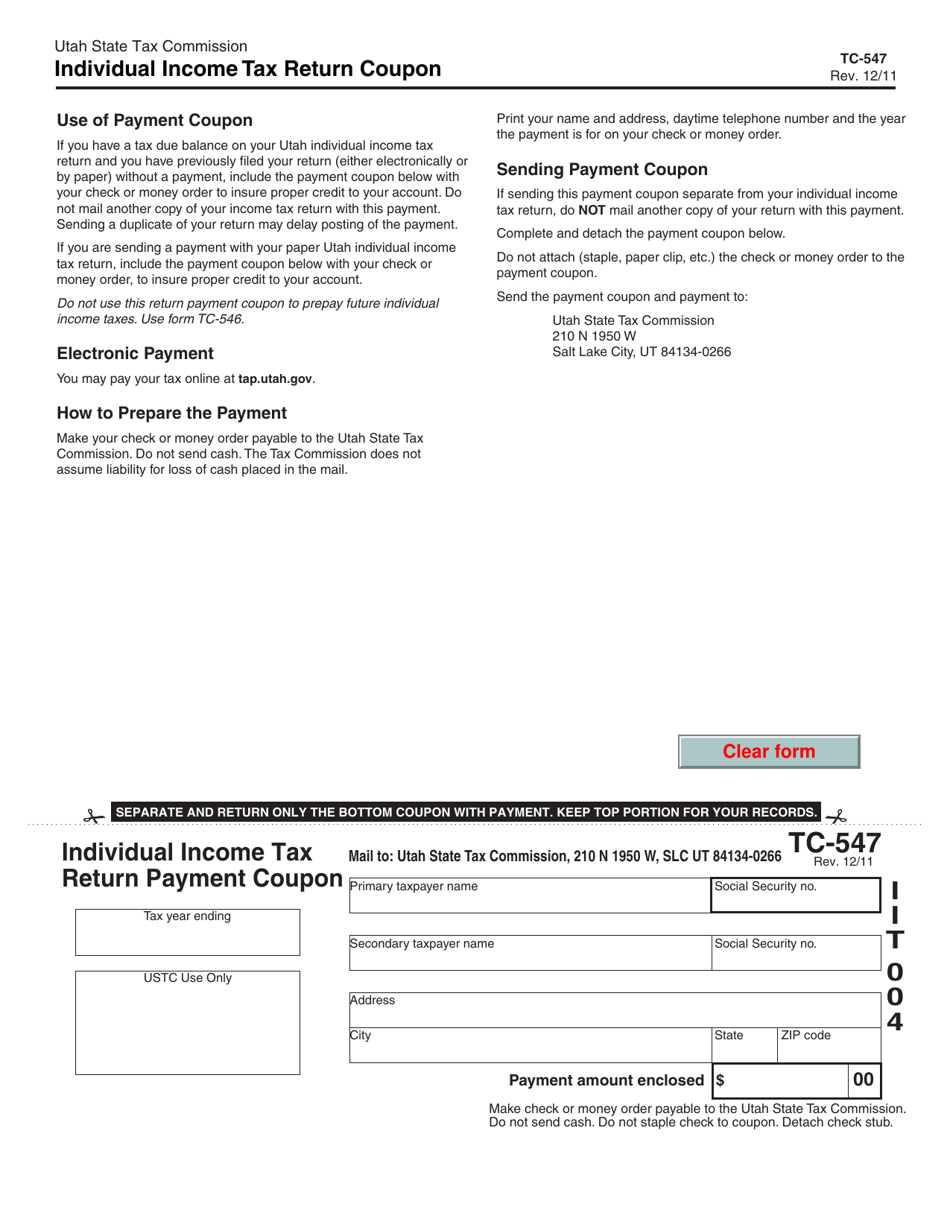

It does not contain all tax laws or rules. Include the TC-547 coupon with your payment. I cant access my TAP account and cant answer the secret question to reset my TAP account.

Frequently asked questions about Taxpayer Access Point. If filing a paper return allow at least 90 days for your return to be processed. Tax Instruction.

There are many free filing options available even for taxpayers with higher incomes. Sales. If you are not redirected to the TAP home page within 10 seconds please click the button below.

Save your work if you will be away from your computer. The Utah State Tax Commissions free. Utah State Tax Commission 210 North 1950 West Salt Lake City UT 84134-0266.

TAP will be down for maintenance starting Friday March 11th at 5pm MDT. Taxpayer Access Point TAP. Motor Vehicle Enforcement MVED.

It does not contain all tax laws or rules. For security reasons TAP and other e-services are not available in most countries outside the United States. SALES TAX ACCOUNT UTAH STATE TAX COMMISSION SALES TAX 210 N 1950 W SLC LIT 84134-0400 Group Payment Coupon for Sales Tax Returns Indicate amount paid for each type.

Please contact us at 801-297-2200 or taxmasterutahgov for more information. Free Federal and State Tax Filing Sources. If you are mailing a check or money order please write in your account number and filing period or use a payment coupon.

Taxpayers can close Outlets other locations Add additional new outlets. Motor Vehicles DMV. For security reasons TAP and other e-services are not available in most countries outside the United States.

This cannot be a negative amount. If you dont have the information you must register for a new TAP using your contact information. Due to our efforts to protect your identity please allow 120 days from the date you filed your return or 120 days from March 1 whichever is later to process your return and refund request.

Pay the IRS. TAP Taxpayer Access Point at taputahgov. Your online session will timeout after 60 minutes of inactivity.

Options you must register for a new TAP account. The Tax Commission cannot issue a refund prior to March 1 unless we have received both your return and your employers required return.

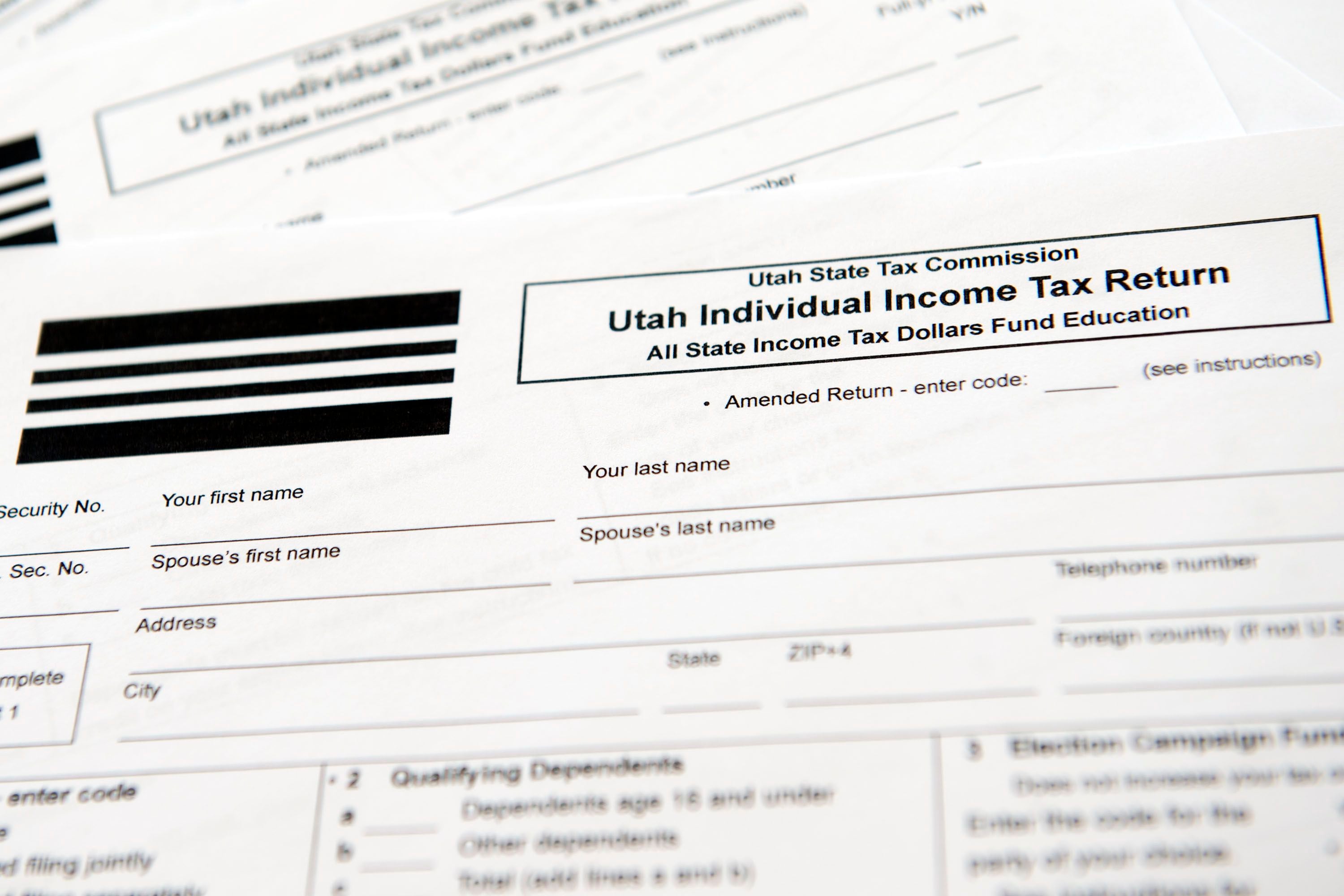

Federal And State Tax Forms Payson Utah

Still Waiting For Your State Income Tax Refund Something Is Probably Wrong

Form Tc 62s Download Fillable Pdf Or Fill Online Sales And Use Tax Return For Single Places Of Business Utah Templateroller

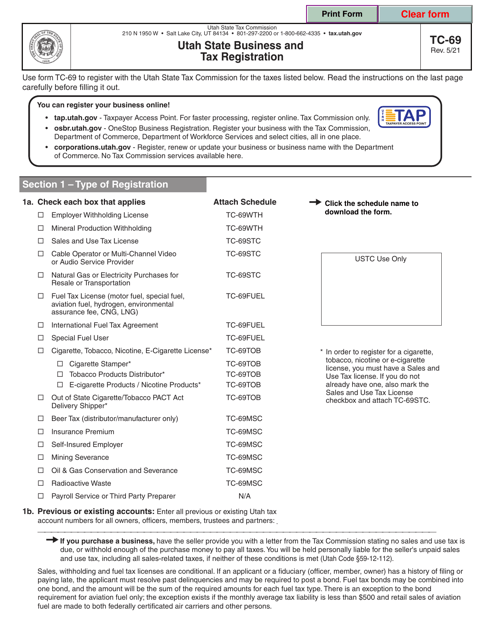

Utah State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

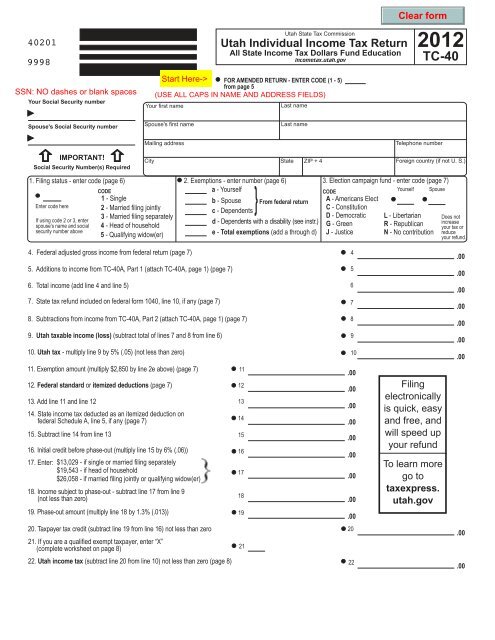

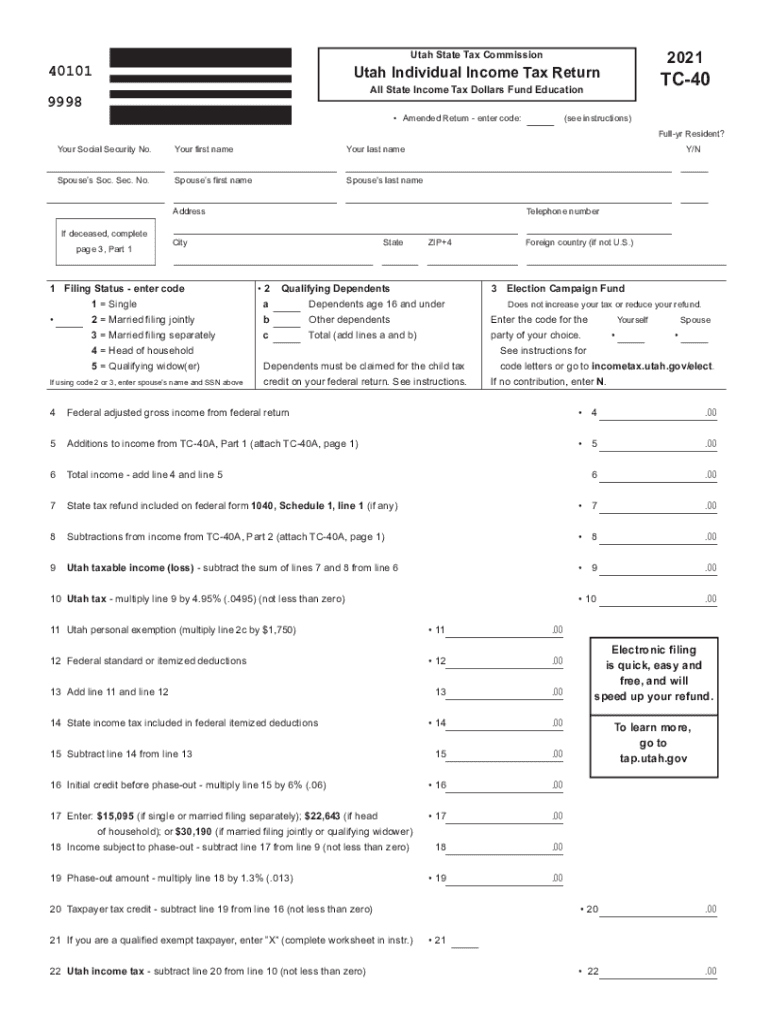

Form Tc 40 Utah State Tax Commission Utah Gov

Form Tc 547 Download Fillable Pdf Or Fill Online Individual Income Tax Return Payment Coupon Utah Templateroller

Still Waiting For Your State Income Tax Refund Something Is Probably Wrong

2011 Form Ut Tc 40 Fill Online Printable Fillable Blank Pdffiller

Utah State Tax Commission Official Website

2021 Form Ut Tc 40 Fill Online Printable Fillable Blank Pdffiller