tax loss harvesting limit

What is tax-loss harvesting. Assuming youre subject to a 35 marginal tax rate the overall tax benefit of.

Turning Losses Into Tax Advantages

These investors are switching their losers out even when they dont have any gains to offset.

. However there are limits to the amount of taxes on ordinary income that can be. The leftover 2000 loss could then be carried forward to offset income in future tax years. And Mary would use the proceeds from the sale to purchase another fund to serve as a.

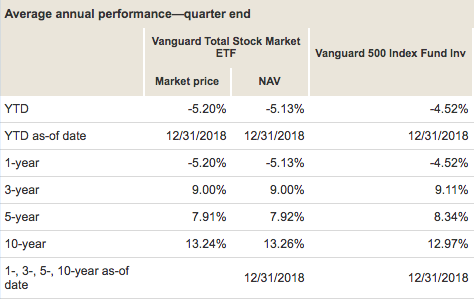

By implementing tax-loss harvesting youd owe 12500 in capital gains tax. In the 24 tax bracket that would come out to 024 4000 960 paid in short term capital gains and 015 4000 600 in long term capital gains. Tax-loss harvesting is when you sell investments at a loss in order to reduce your tax liability.

Even better any remaining tax losses can be used to reduce your. Limit capital gains for your clients Help your clients offset short-and long-term capital gains with automatic tax-loss harvesting of client accounts. Tax-loss harvesting is a complicated investing strategy.

Even if you cant claim the maximum 3000 net loss you can still reduce the value of your gains and save on taxes that way. What is tax-loss harvesting. Once you have 50000 or more in your account you can sign up for its free tax-loss harvesting service.

Contact a Fidelity Advisor. Contact a Fidelity Advisor. This can significantly reduce an investors tax bill.

How tax-loss harvesting works. Whenever total capital gains and losses for the year add up to a negative number a net capital loss is incurred. Generally those losses can then offset.

So if you have a 4000 gain and a. If the net capital loss is less than or equal. They do it because current tax rules allow you to store investment losses to deduct.

The result of tax-loss harvesting is that taxes are only paid on the net profitthe difference between the gains and the losses. To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss. Tax-loss harvesting offers the biggest benefit when you use it to reduce regular income since tax rates on income typically run higher than.

Tax Liability 450000 20 100000 37 Tax Liability 127000. 75000 50000 x 15 60000 25000 x 25 12500. There is no limit to the amount of investment gains that can be offset with tax-loss harvesting.

Through a strategy called tax-loss harvesting investments that are in the red can be your ticket to a lower tax bill up to 3000 a year. No limit Under 50. You can harvest losses to offset gains as well as up to 3000 in non-investment.

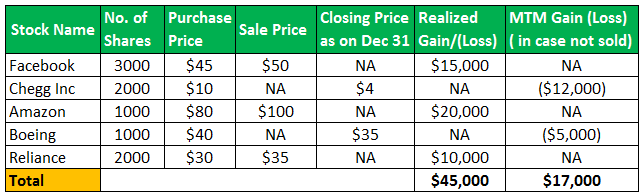

Is there a limit to tax-loss harvesting. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. If the investor wants to reduce the tax liability he can use tax loss harvesting by selling Fund Y and Z and can offset.

The current tax rules allow you to use capital. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Taxpayers can often use tax-loss harvesting to lower their tax burden by selling their investments at a loss.

In this example the final 2000 is carried. However Internal Revenue Service IRS rules allow. In addition the IRS allows you to use up to 3000 of the remaining capital loss to lower your ordinary taxable income each year.

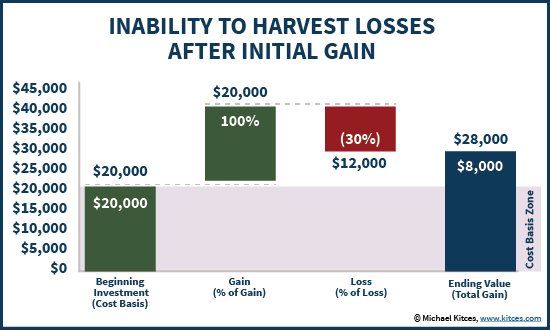

Tax loss harvesting cannot turn a loss into a gain but it can mitigate your losses by reducing your tax liability. Ad 100s of Top Rated Local Professionals Waiting to Help You Today. If your losses completely.

Even better if your capital losses are more than your gains you get a bonus. There is a 3000 limit on the amount of capital gains losses that a federal taxpayer can deduct in a single tax year. The beauty of tax-loss harvesting is that you can use capital losses to offset all your capital gains.

Tax loss harvesting involves selling a losing investment in order to generate capital losses that you can write off on your tax return. Investors and their advisors usually look at tax loss harvesting at the end of the year when the April tax date is approaching Ryan said in an interview. Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job.

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

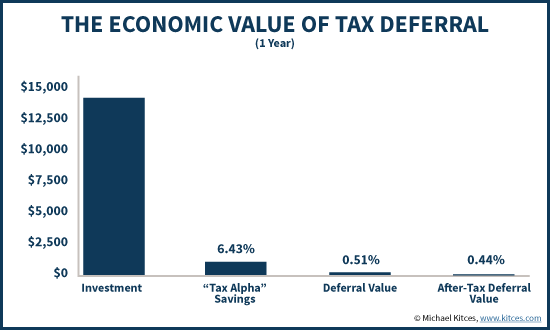

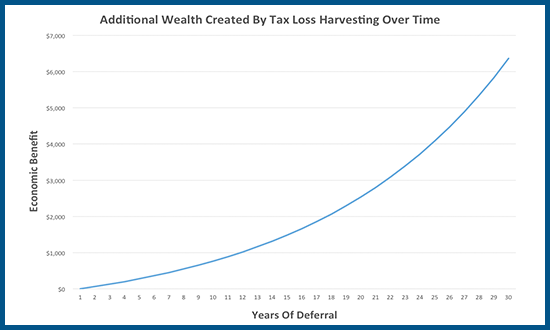

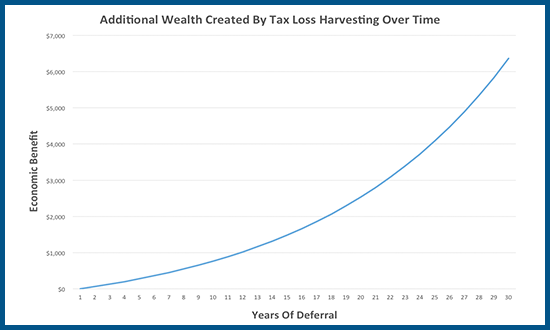

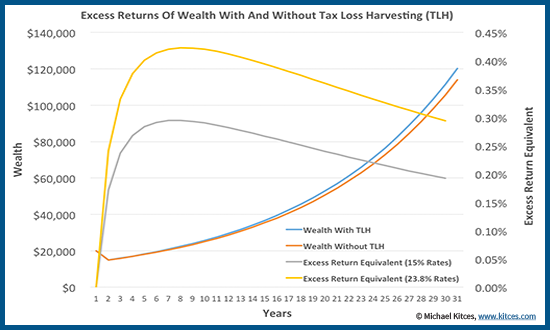

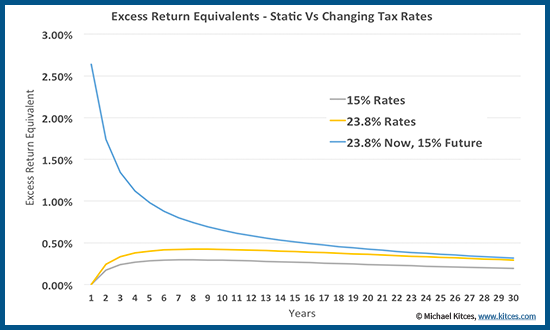

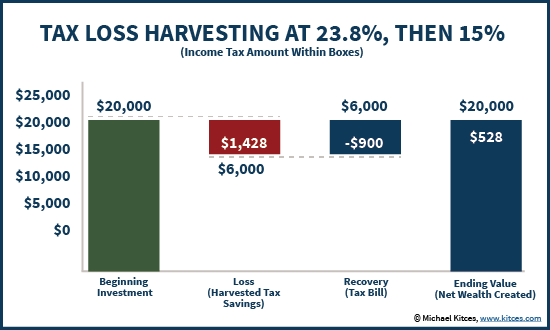

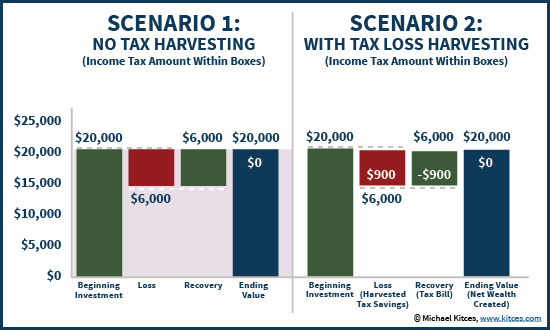

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting And Tax Gain Harvesting Step By Step

Tax Loss Harvesting Definition Example How It Works

Tax Loss Harvesting And Wash Sale Rules

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Everything You Should Know

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Definition Example How It Works

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Example Of Tax Loss Harvesting How Does It Work

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Reap The Benefits Of Tax Loss Harvesting